The direct method is often used in tandem with the cash method of accounting, where money is only accounted for when it changes hands. Larger, more complex firms, on the other hand, may find it too inefficient to devote the necessary resources to the direct method, so the indirect alternative becomes faster and simpler. This option may also be more beneficial for long-term planning, as it gives a wider overview of the firm’s overall cash flow. The indirect method lacks some of the statement of cash flows direct vs indirect transparency that the direct method offers. This could raise concerns if you operate in a highly-regulated industry, or if you often face demands from shareholders and stakeholders to provide a clear and easily comprehensible picture of the company’s financial position. The indirect method, by contrast, means reports are often easier to prepare as businesses typically already keep records on an accrual basis, which provides a better overview of the ebb and flow of activity.

- As the name would suggest, the direct method (sometimes referred to as the income statement method) takes a direct approach to building the cash flow statement.

- It has been demonstrated that decision-makingin an external environment have an impact on organisational change and creativity.

- They include requirements for transparency, data availability, and adherence to accounting standards.

- Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities over a pre-defined period.

- Gains and/or losses on the disposal of long-term assets are included in the calculation of net income, but cash obtained from disposing of long-term assets is a cash flow from an investing activity.

which section of the statement of cash flows is prepared using either the direct or indirect method?

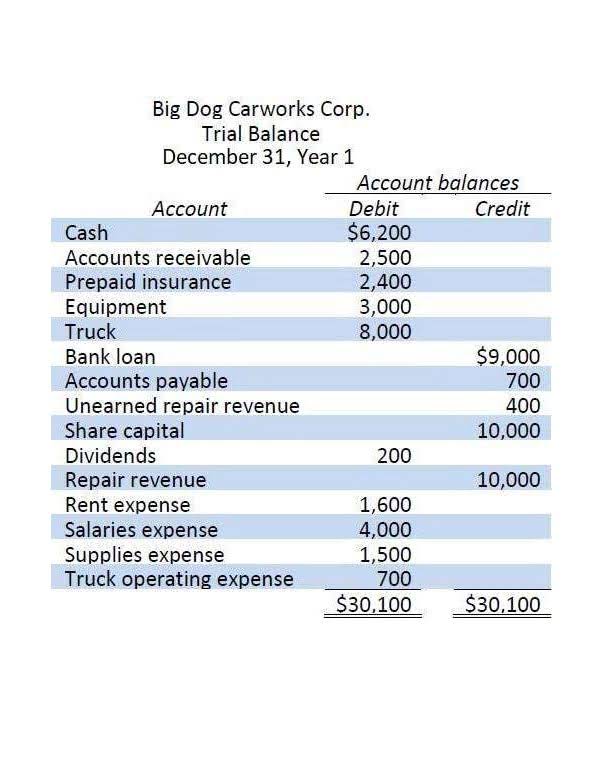

Your direct cash flow report is a more structured way of tracking your banks income statement over a certain period of time. All of this information and transactions are then collated together in an organised manner. Suppose we are provided with the three financial statements of a company, including two years of financial data for the balance sheet.

Cons of the Direct Method

The Finmark Blog is here to educate founders on key financial metrics, startup best practices, and everything else to give you the confidence to drive your business forward. The indirect method is preferred by the International Financial Reporting Standards (IFRS), making it a common choice both among small and large companies for compliance purposes. Another advantage of the direct method is the specificity and insights it provides compared to the indirect method. Instead, the direct method is more clear in how it’s calculated and can give you a better idea of your current cash standing. Despite the merits and drawbacks of any of the methods, the choice between direct/indirect flow is entirely yours. Finance Strategists has an advertising relationship with some of the companies included on this website.

Current Operating Liability Increase

The indirect method is also much quicker than the direct method because it utilizes information readily available on the income statement and the balance sheet. One was an increase of $700 in prepaid insurance, and the other was an increase of $2,500 in inventory. In both cases, the increases can be explained as additional cash that was spent, but which was not reflected in the expenses reported on the income statement. The corporation can use either a direct method or an indirect cash flow technique for reporting purposes. It depends entirely on the situation and the compliance criteria of the company. The popularity of the indirect way of cash flow generally outnumbers that of the direct cash flow method.

What is the difference between the direct method and the indirect method for the statement of cash flows?

- When treasury stock is resold at a price above cost, the difference between the cost of the treasury stock and the sale price is recorded as an increase to additional paid-in capital.

- Common activities that must be reported as investing activities are purchases of land, equipment, stocks, and bonds, while financing activities normally relate to the company’s funding sources, namely, creditors and investors.

- The indirect method lacks such deep insights since the net cash flow metric is indirectly calculated from the other financial statements.

- In short, the direct method is helpful when you need to make it easy for other people—like investors and stakeholders—to understand your cash flow.

- Thus, when accounts payable increases, cost of goods sold on a cash basis decreases (instead of paying cash, the purchase was made on credit).

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Cash flow is the total amount of cash that is flowing in and out of the company. Free cash flow is the available cash after subtracting capital expenditures.

- Larger, more complex firms, on the other hand, may find it too inefficient to devote the necessary resources to the direct method, so the indirect alternative becomes faster and simpler.

- In the second scenario, revenue is included in the net income on the income statement, but the cash has not been received by the end of the period.

- The indirect method is commonly used by a number of businesses across the world.

- All of this information and transactions are then collated together in an organised manner.

- The purpose of our cash flow is to reconcile cash so we will use the figure later.

How to Prepare a Cash Flow Statement

The indirect method lacks such deep insights since the net cash flow metric is indirectly calculated from the other financial statements. So even if the company chose to use a direct method cash flow statement for internal reporting purposes, they’d still need to prepare an indirect method statement to stay compliant–doubling their https://www.bookstime.com/ team’s workload. Plus, if a business is a publicly traded company, they will be required to report an indirect method cash flow statement under Generally Accepted Accounting Principles (GAAP) requirements. Then, you will indirectly calculate the net operating cash flow for the period after reconciling all non-cash transactions.

- This begins with putting the right process in place to build the best cash flow statement for your business–in whatever time you have.

- In accounting and finance, the cash flow statement (CFS), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under accrual accounting.

- Never take your eyes off the cash flow because it’s the lifeblood of business.

- Simply dividing the amount of money a bank needs to keep in reserve by the amount of money it has on deposit to get the required reserve ratio.

As for the balance sheet, the net cash flow reported on the CFS should equal the net change in the various line items reported on the balance sheet. This excludes cash and cash equivalents and non-cash accounts, such as accumulated depreciation and accumulated amortization. For example, if you calculate cash flow for 2019, make sure you use 2018 and 2019 balance sheets. Leverage in finance refers to any strategy that involves borrowing money to make purchases with the expectation that future earnings will be significantly greater than the cost of borrowing. When you borrow money to make an investment with the aim of higher returns, you are using financial leverage.

Leave A Comment